Press Releases

April 26, 2024

The CRREM initiative releases a report on Green Governance and how to implement and develop feasible Net Zero Transition Plans in the real estate industry. The report was authored by the CRREM team and supported by EPRA and UNEP FI.

April 07, 2022

EPRA and the Carbon Risk Real Estate Monitor initiative (CRREM) have entered a partnership to educate EPRA members, and the listed real estate sector more broadly, on the application of the CRREM resources.

March 21, 2022

Following extensive consultation with industry stakeholders, EPRA introduced a new financial KPI, the EPRA Loan-to-Value (LTV) ratio, to respond to a need voiced by investors, analysts and property companies.

January 12, 2022

On January 12, 2022, EPRA launched the EPRA Developers Research Benchmark, a non-commercial benchmark designed to allow its constituents to assess themselves against each other.

December 21, 2021

It was EPRA’s view from the beginning of the process that the uniqueness of REITs may require a tailored solution, and we highly appreciate the decision the OECD has taken for the REIT sector.

November 12, 2021

Buildings account for 40% of energy consumption and 36% of CO2 emissions in the EU. Any hope of delivering the Paris Agreement goals is dependent on the real estate sector’s actions to reduce this impact.

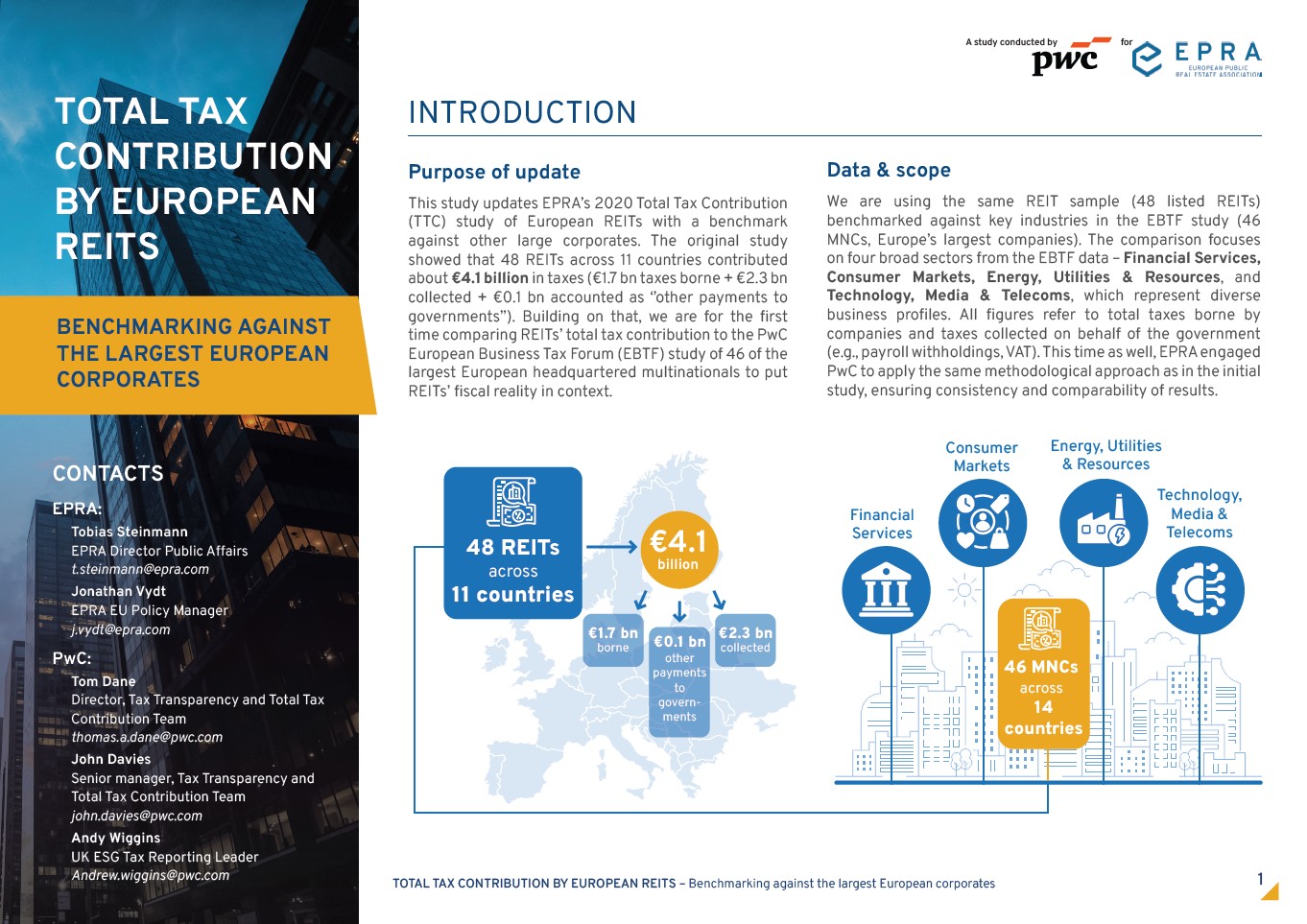

November 19, 2020

European real estate investment trusts (REITs) are estimated to have been responsible for a total tax collection of 4.1 billion euros (£3.7 billion) last year, according to new research published on November 19 by EPRA.

September 09, 2020

EPRA will today announce that Méka Brunel, CEO of Gecina, is taking over the Chair of the listed real estate industry trade body at the organisation’s Annual Conference later this afternoon.

September 08, 2020

EPRA's BPR for financial reporting have again seen a record level of companies awarded according to the annual survey conducted by Deloitte.

September 08, 2020

The widespread uptake in sustainability reporting is an indication of the real estate industry's growing commitment to helping investors and stakeholders understand its role in contributing to and tackling societal and climate change challenges.

June 30, 2020

EPRA has published new guidance for listed property companies already reporting EPRA Sustainability Best Practice Recommendations (sBPR) to meet the reporting requirements of the Task Force on Climate-related Financial Disclosures (TCFD).

January 16, 2020

A model developed by Concordia University, under a research paper commissioned by EPRA, for the first time addresses investors’ inability to access standardised metrics for evaluating the monetary value and impact of property companies’ contributions to ESG initiatives.

November 04, 2019

Following extensive consultation with industry stakeholders, EPRA has announced changes to the Net Asset Value (NAV) measurement to reflect the significant evolution of the listed real estate sector over the last 16 years, when the Best Practices Recommendations guidelines were first introduced.

September 11, 2019

Oxford Economics study finds “reassessment of strategic allocations to listed real estate justified”.

September 10, 2019

EPRA has taken a further step in addressing the lack of robust and consistent ESG public data in the listed real estate sector. Since the introduction of the EPRA sBPR)in 2011, the sole industry standard for ESG reporting, the Association has today launched a comprehensive database covering publicly available ESG data from European listed real estate companies.

September 11, 2019

Figures for the 20 years that EPRA has represented the European listed real estate industry show a 320% return in the sector and 7.7% annualised over the period.

September 11, 2019

EPRA's campaign to improve ESG reporting by listed property companies has seen a major uplift in the eight years since it launched its sustainability Best Practices Recommendations (sBPR).

September 11, 2019

The EPRA BPR for financial reporting have once again achieved a record level of compliance, according to the annual survey conducted by Deloitte, providing investors and stakeholders with transparent and comparable information to further confidence in the European listed real estate sector.

July 20, 2019

The new PEPP regulations are set to unlock vast investment potential in the LRE sector, with a total EUR 231 billion set to flood the European equities market, according to a study undertaken by EY.

June 08, 2019

The European Commission has accepted proposed changes put forward by EPRA to reduce the Solvency II capital requirements for investments in listed real estate.

September 07, 2018

Following the quarterly index review on 6 September 2018, HIAG Immobilien (Swiss industrial), Montea (Belgian, Dutch and French logistic warehouses) and Civitas Social Housing (British social residential sector) were accepted for inclusion in the FTSE EPRA Nareit Developed Europe Index.

September 05, 2018

Listed real estate produced the highest average institutional investment returns in the UK (2010 – 2016) and the second largest in the Netherlands (2005 – 2016) across eight major asset classes, a study by researchers CEM Benchmarking of European institutional investors concluded.

September 05, 2018

The European listed real estate industry is improving the gender diversity of its management teams with women making up 28% of company board memberships last year, compared with 22% in 2015, a study from the European Public Real Estate Association presented at EPRA’s Conference in Berlin shows.

September 05, 2018

Large and accelerating investment flows into alternative property sectors are forecast to drive a doubling in the size of the FTSE EPRA Nareit Developed Europe listed real estate to around EUR 500 billion within the next five years.

September 05, 2018

The European Public Real Estate Association (EPRA) made a record number of Awards to European listed property companies for meeting its Best Practices Recommendations for sustainability reporting (sBPR) at its annual conference in Berlin on Wednesday. Awards will switch to a broader assessment of the sector’s disclosure on environmental, social and governance (ESG) performance from next year.

September 05, 2018

Compliance with Best Practice Recommendations for financial reporting has risen to record levels, showing that EPRA's three-year programme to increase adoption by listed property companies has yielded successful results the survey conducted by Deloitte shows.

May 16, 2018

Emerging technologies such as Virtual Reality, Artificial Intelligence and Blockchain will optimise the efficient use of real estate, transforming business models and disrupting those that are unable to keep pace with the changes, new research supported by the EPRA concludes.

April 27, 2018

EPRA and the real estate sustainability benchmarking organisation GRESB have completed the first comparative Gap analysis of EPRA’s latest sBPR Guidelines with the 2018 GRESB Real Estate Reference Guide that encompasses public and private equity property investments.

September 06, 2017

Changing EU capital requirement rules for insurers so that listed real estate is treated like direct property investment could result in a sharp increase over time in investment flows to the industry

September 06, 2017

FTSE Russell elevates Real Estate as the 11th ICB Industry

September 06, 2017

EPRA has surpassed its 2018 targets for the number of listed property companies complying with its Best Practices Recommendations (BPR).

September 06, 2017

Europe’s listed property industry achieved a record number of top Awards for sustainability reporting, as spotlight turns to social and corporate governance factors

September 01, 2017

Carmila (French retail), Catena (Swedish industrial) and Xior Student Housing (Belgium) were accepted for inclusion in the FTSE EPRA/NAREIT Developed Europe Index, following the quarterly index review.

May 23, 2017

It takes about 18 months for an investment in listed real estate to shed the influence of the general equities market and to start mirroring the performance of the companies’ underlying portfolio, new research by MSCI concludes.