Resilience and Recovery: European Real Estate Developers Show Positive Signs in Challenging Times

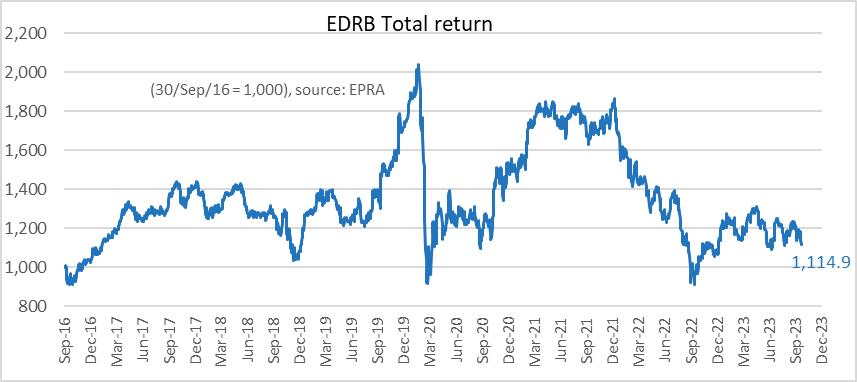

The European real estate development sector has experienced a period of turbulence and uncertainty due to a combination of factors, including a stagnating European economy, rising interest rates, restrictive credit conditions, and uncertainties related to the Chinese property sector crisis. However, there could be some good news on the horizon. The recently conducted biannual review of the EPRA Developers Research Benchmark (EDRB) reveals that European developers have begun to stabilize. In this blog post, we will delve into the results of the EDRB review, providing insights into the performance of European developers.

Background and index results

The EPRA Developers Research Benchmark (EDRB) is a benchmark designed for research purposes. Its primary goal is to represent the aggregated performance of the most significant and liquid real estate developers in Europe, including both residential and commercial developers. Currently, the EDRB comprises 29 constituents, 11 from the UK and 18 from continental Europe and Ireland. These constituents collectively have a free float market capitalization of 112 billion EUR, as of October 20, 2023. Within EDRB, two sub-indexes are calculated: Liquid Developers, which includes companies with a free-float market capitalization above EUR 500 million, and a Residential Developers sub-index.

EPRA reviews the benchmark on a biannual basis, having just finalized the 2nd one of the year. In general, no additions or deletions to the EDRB have been observed. The French constituent, Altarea has been reclassified from Diversified to Pure Residential, as well as deleted from the Liquid Developers sub-index, in addition to the UK residential builder – Crest Nichols.

Positive Returns for European Developers

One of the most encouraging findings is the positive performance of the benchmark, returning 12.8% on an annual basis and 4.8% year-to-date (see table below). Both Liquid Developers and Residential Developers have also performed well. The Liquid Developers sub-index has returned 3.61% year-to-date, while the Residential Developers sub-index has shown even better results, with a YTD return of 4.92%, as of October 20, 2023. This demonstrates that despite the challenging economic environment, developers across Europe are managing to generate returns for their investors.

Performance by Country

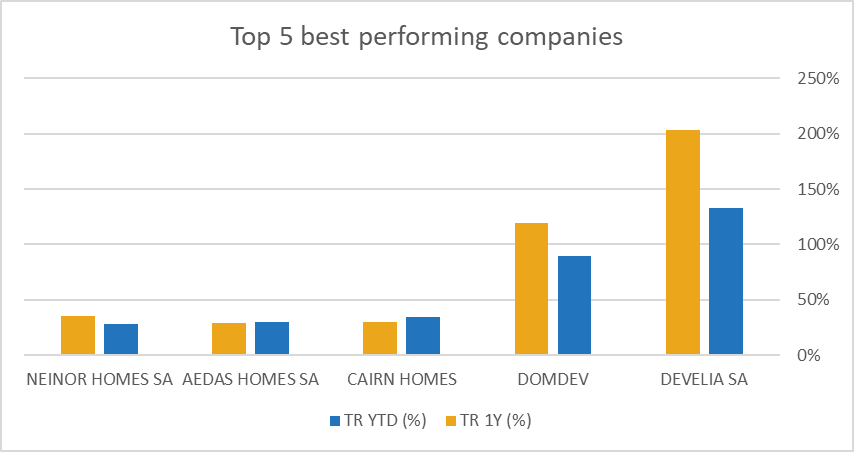

When examining performance by country, Poland has emerged as an outlier, with an impressive 166% return on a one-year basis and 115.47% year-to-date. Spain also fared well, boasting a 42.64% return over the past year and a 28.36% YTD return. The United Kingdom and Ireland have not lagged behind, with both countries achieving strong performances, each with returns surpassing the 10% mark. These performances by country illustrate that there are pockets of resilience and growth in the European real estate development sector.

Outstanding Company Performances

Zooming in on individual companies, it's evident that certain players have stood out with remarkable performances (List of constituents below). Two Polish constituents, Develia and DomDev, deserve special mention, achieving returns of 202% and 119%, respectively, on an annual basis. Meanwhile, two Spanish constituents and EPRA members, Neinor Homes and Aedas Homes, have also performed exceptionally well, posting returns of 35.65% and 29.30% on a one-year basis.

The Bottom Line

The performance of the EPRA Developers Research Benchmark (EDRB) offers a glimmer of hope for the European real estate development sector. Despite the headwinds posed by a stagnant economy, rising interest rates, and other macroeconomic challenges, European developers have shown signs of stabilization. Both the Liquid Developers and Residential Developers sub-indices have delivered positive returns, and certain countries and companies have outperformed expectations.

Notably, over the past decade, the European listed real estate developers' sector has professionalized and become a significant actor in the listed real estate universe. This evolution underscores the industry's resilience and adaptability, enabling it to weather difficult periods and continue to generate value for investors. Moreover, the performance of these stocks reveals that many of them are significantly undervalued, potentially offering an attractive entry point for investors seeking to increase their exposure to this sector. Additionally, adding European developers to an investor's portfolio could be a compelling strategy for those looking to diversify and complete their investment portfolios.