Listed Real Estate as an Inflation Hedge across Regimes*

By Jan Muckenhaupt, Martin Hoesli, and Bing Zhu

Due to the high levels of money supply increases by central banks in response to the COVID-19 pandemic, the high levels of debt, and military confrontations, we are experiencing large price swings in energy and commodity markets and a global economic slack. In October 2022, inflation in the euro area rose to 9.9% year-on-year, the highest level since the introduction of the Euro currency. In the UK, the figure has just become a double-digit one. In the U.S., the latest figure suggests a slightly lower rate (about 8%), but still a figure that is markedly higher than those of the recent past. Central banks like the European Central Bank, the Bank of England, or the Federal Reserve are already attempting to curb the massive inflation with higher interest rates. With the unexpectedly strong boost to inflation, further interest rate increases were announced and implemented. This clearly provides for a distressed economic background that presents challenges in determining the allocation of a portfolio across the various asset classes.

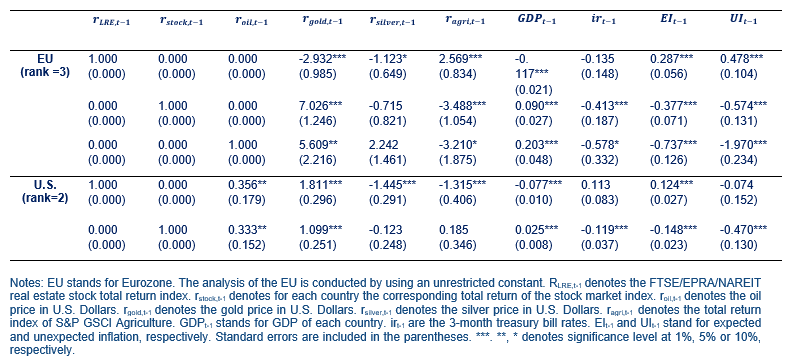

Table 1: Long-Term Equilibrium Relationships (β-vectors)

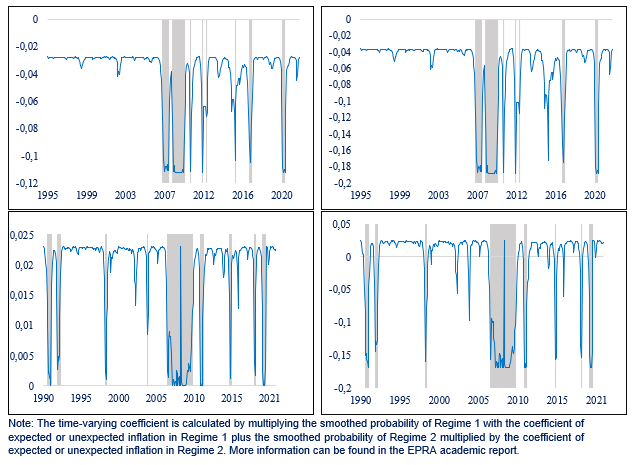

Using monthly return data for listed real estate companies from 1990 to 2021 for five economies (Eurozone, the U.S., UK, Japan, and Australia), we overall find inflation-hedging properties for listed real estate (LRE). In more specific terms, listed real estate assets are a reliable hedge against inflation in the long-term, but mainly based on expected inflation. The reason for this can be attributed to the fact that many commercial leases are inflation-adjusted, resulting in a positive adjustment in the capital value of assets. For the Eurozone and Japan, the evidence is even stronger as those countries experience long-term positive inflation hedging against both expected and unexpected inflation (Table 1 illustrates the long-term equilibrium relationships for the EU and U.S.). The short-term inflation hedging ability also varies across countries. For instance, in the U.S., we see a significant short-term impact of expected and unexpected inflation on LRE performance in Regime 1 (non-crisis periods). In contrast, unexpected inflation has a significant negative impact on LRE returns in Regime 2 (crisis periods). In other words, in the short term, LRE can hedge against expected and unexpected inflation, but the hedging ability becomes negative during the crisis period. However, in the Eurozone, we find significant perverse hedging characteristics in both regimes (see Figure 1). According to our analysis at the sectoral level, office properties have positive protection characteristics against expected and unexpected inflation in the United States, the United Kingdom, and the Eurozone. The evidence for other sectors is not as clear cut, albeit the sector-level analyses are performed over a shorter period than the aggregate analyses due to data availability.

Figure 1: Time-Varying Short-Term Impact of expected Inflation (left) and unexpected Inflation (right) on Eurozone (top) and U.S. (bottom) Real Estate Equity Returns

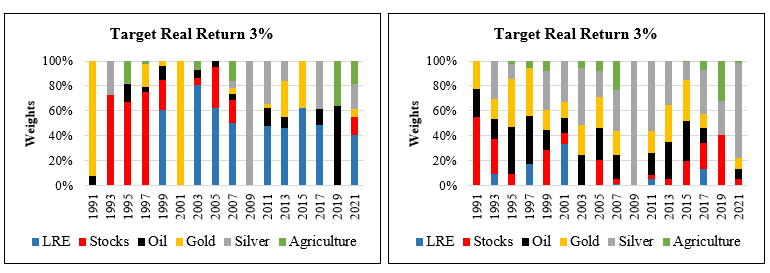

Our paper also demonstrates that LRE can play a significant role in the inflation-hedging portfolio of an investor. This is achieved by considering a portfolio target real return of 3 percent per annum over a two-year period. The average allocations for the U.S., UK, Japan, Australia, and the Eurozone over the entire period are 6.35%, 19.21%, 16.02%, 48.81%, and 31.21%, respectively, clearly highlighting the importance of holding listed real estate investments in a mixed-asset portfolio. Figure 2 describes the weights of shortfall probability for the U.S. and Eurozone.

Figure 2: Weights of Shortfall Probability for the Eurozone (left) and the U.S. (right)

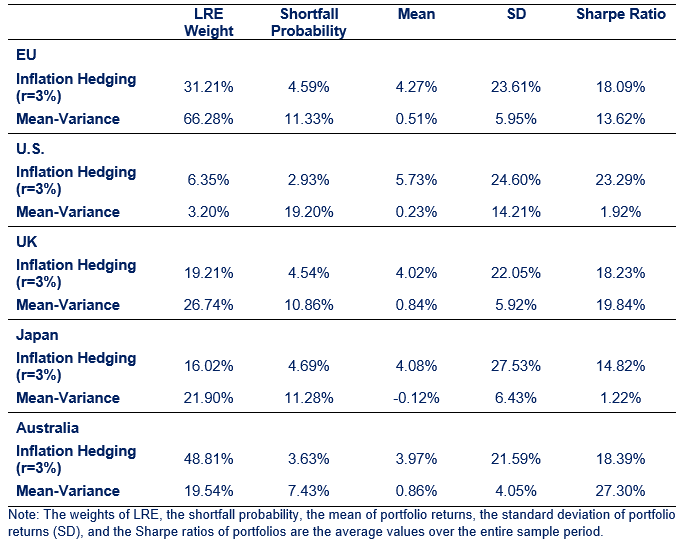

We maintain that optimizing across asset classes using expected shortfall as the risk measurement provides for more realistic and less extreme allocations to listed real estate than when the classic mean-variance approach is used, as using variance as the risk measurement may not correspond best to investors' objectives. The inflation-hedging portfolio provides a higher risk-adjusted return (Sharpe ratio) than the mean-variance approach for the Eurozone, the U.S., and Japan. It also achieves a lower shortfall probability and a higher average expected return than the mean-variance portfolio in all five regions (see Table 2).

Table 2: Average Summary Statistics of Portfolios with 2-year-Investment Horizon over the Entire Sample Period

* This article is based on an EPRA commissioned academic paper. Read the full report here: https://bit.ly/3I9YDv8