Interest Rates and inflation: Challenges for Listed Real Estate?

By David Moreno, EPRA Indexes Manager

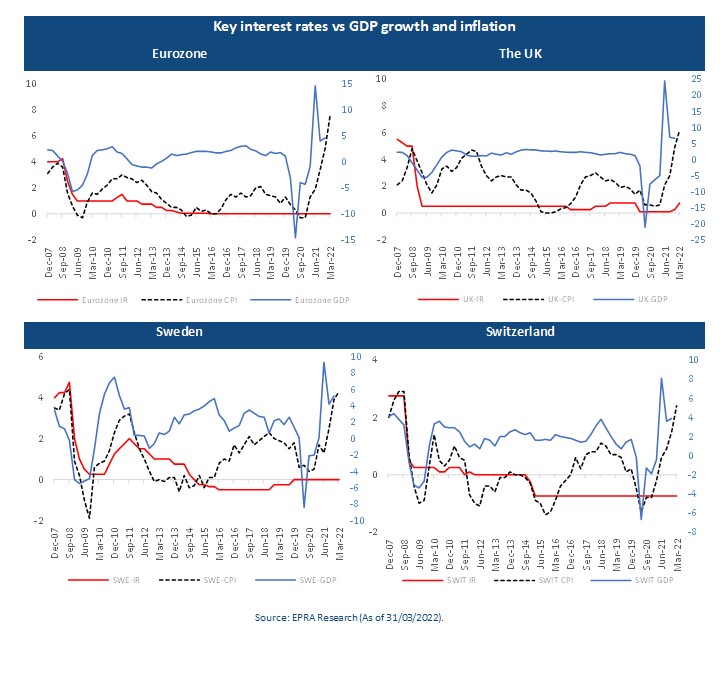

Economic growth, inflation and nominal interest rates remained relatively low and stable across Europe in the past 15 years, but the global pandemic and the war in Ukraine have changed this picture. Now the continent is severely affected by some supply issues and skyrocketing prices of oil, gas and other commodities, pushing inflation to levels not seen in almost 20 years. As a result, central banks are now turning to more restrictive monetary policies. Therefore, higher interest rates and higher inflation are here to stay for some time, representing a challenge for listed real estate, but the industry is well prepared for it.

Future inflation does not necessarily imply an increased risk for property investors. In our latest inflation report we discussed this issue commenting that “property companies see changes in both revenues and expenses when inflation rises. In the case of European listed real estate companies, there is evidence of a strong and positive correlation between corporate profits and inflation as well as shareholders’ returns and inflation” (EPRA, 2022)[1].

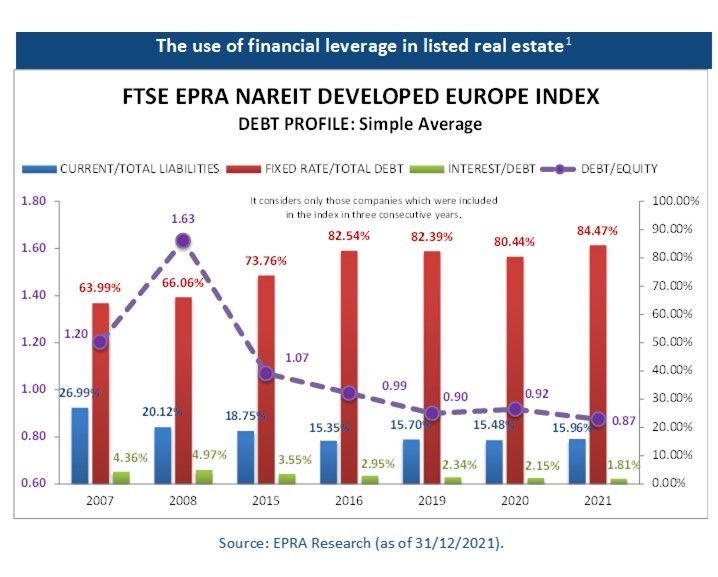

In the short term, rising inflation, higher interest rates and weaker economic growth have led to higher volatility, but many listed property companies across the continent have made significant efforts during the last decade to improve their debt profile and are prepared for this context. Today the vast number of European property companies have less leverage (average LTV below 37%) and more outstanding debt contracted at a fixed-interest rate (around 85% of the total) with maturities above 5 years. As a consequence, debt issued by listed property companies has become less sensitive to changes in nominal interest rates.

[1] Source: Inflation and Short-Term Impact on Listed Real Estate (EPRA, 2022).

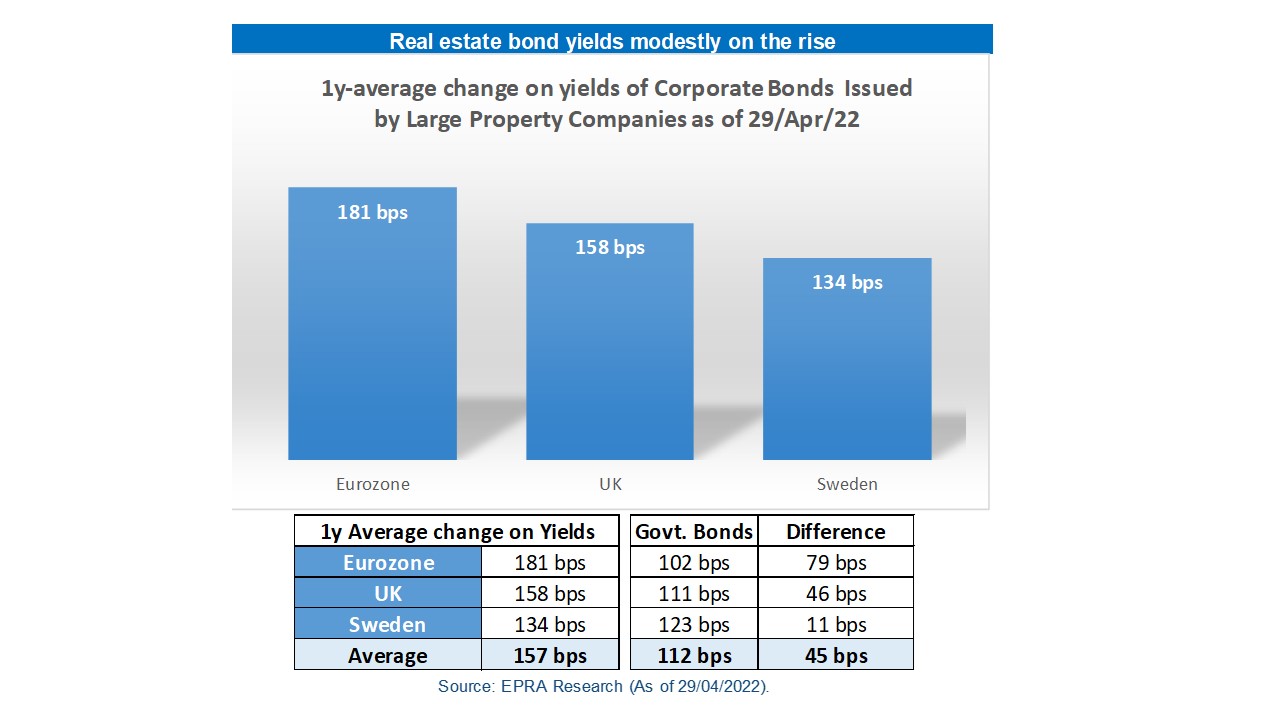

Between Apr/21 and Apr/22, government bond yields for Germany, Sweden and the UK increased 112 bps in average, while the corporate bonds of property companies increased 157 bps, representing an increase in the risk premium of 45 bps (in function of maturity). This seems to be very reasonable, and in our view, reflects how investors continue trusting the listed real estate industry.

Listed real estate can differentiate itself from other asset classes, even in the current market conditions. Rental flows are (partially) indexed, which could drive up valuations and corporate profits. Conservative financing policies could be considered as a strength by many investors, and several property markets still show healthy fundamentals and some signals of undersupply, therefore supporting the expectation of rental growth in the near future and the idea of a resilient industry that is well prepared to face this challenging economic context.