Historical bearish periods and recoveries in

European Listed Real Estate

By David Moreno, CFA. Indexes Manager at EPRA

After years of low inflation and low interest rates, stable economic growth and positive financial returns, the European economy is now facing a new paradigm, where the monetary policy is turning contractive, struggling to control a double digit inflation, pushing the continent to the edge of a long recession and boosting a deep bearish trend in most of the financial markets, where the listed real estate industry has not been immune.

In 2022, the FTSE EPRA Nareit Developed Europe Index showed negative returns in 7 of the 9 months until September, reaching a total return of -36.6% in GBP (-39.4% in EUR), becoming this trend the second worst annual drop in history just behind 2008 GFC (-44.8% in GBP). Of course, the rise in nominal interest rates is the main culprit but the pandemic has not really gone yet either.

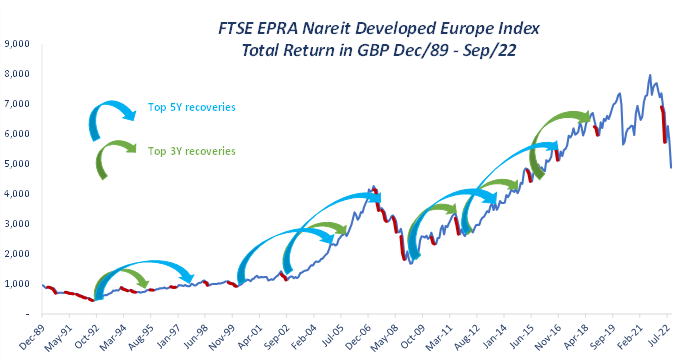

When looking at the entire history of the index since Dec/89, it is possible to identify 21 bearish periods where the index showed negative returns in 3 or more consecutive months. This is an interesting result given the very long period covered here with at least 3 different economic cycles, with different characteristics of economic growth, inflation, interest rates and real estate trends.

Graph 4: Bearish periods and recoveries in European Listed Real Estate

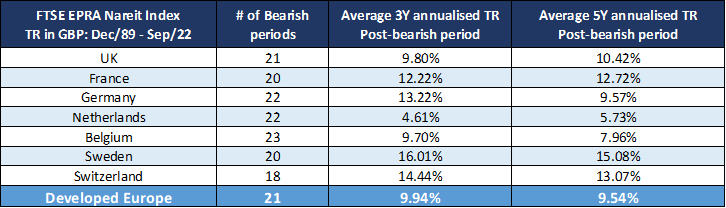

However, what it is even more interesting to look at is the recovery observed after those periods. For the continental index, the average annualised total return for the 3 and 5 years following those bearish periods was 9.94% and 9.54% respectively. Differences across the countries are also relevant since those with a more diversified group of constituents by property sectors (UK, Belgium) are also the ones showing a more stable recovery, while those with more concentration of specific sectors (Germany, Netherlands) are the ones showing more volatile results. Finally, looking at the top 5 recoveries for the continental index, the average annual return in the 3-years following those periods was 19.75% and 18.60% in the following 5-years. Finally, looking at the Eurozone since 1999 when the Euro was introduced, the FTSE EPRA Nareit Eurozone Index showed 11 different bearish periods and the average annual total return in euros in the posterior recovery period was 13.23% for 3- years and 11.75% for 5-years, a bit higher than the figures for the continental index given the exclusion of the non-eurozone countries and a less significant currency effect.

Table 2: Bearish periods and recoveries in European Listed Real Estate

Source : EPRA Research

Of course, it is possible to argue that the market conditions under each of these episodes were entirely different than the market conditions observed today, however, it is clear that the current bearish trend looks too extended and so the expectations for the recovery are very promising under a medium and long term perspective, perhaps not entirely aligned with the previous recoveries observed 3 and 5 years after those bearish periods, but definitely somehow close.