Green goals shaking debt markets

By Lourdes Calderón Ruiz, EPRA Senior Analyst Research & Indexes

Investors' demand for corporate green bonds, considered as one of the main instruments to green the economy and the financial sector, is growing rapidly. It is accompanied by an awareness of the need to change our way of living in order to save our planet. As a consequence, the bond issuance by listed real estate players has experienced a strong growth across Europe in recent years, and we could even say that green bonds are on track of becoming a new financing standard for many players in the market.

Since 2013 until today, EPRA members issued EUR 40 billion green bonds, of which 76% were issued by constituents of the FTSE EPRA Nareit Developed Europe Index. More than 50% of the total amount was issued in 2021-2022 only, and we are expecting further growth by the end of the year.

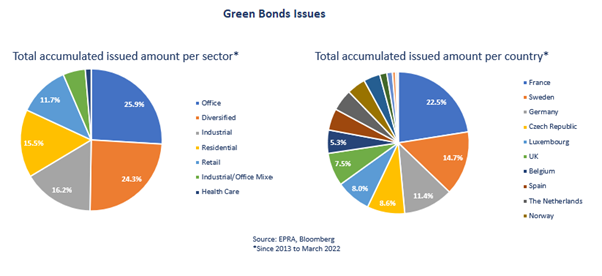

In terms of the cost of the debt, it is interesting to see how the weighted coupon has decreased over the years from 2.88% in 2013 to 1.63% in March 2022, and how the weighted maturity remained above 7 years. From a country point of view, France and Sweden are taking the lead; together they issued nearly 40% of the total amount. However, it is also remarkable how each year more and more countries are following the trend. In terms of sectors, office-specialists are leading the way, representing 25.9% of the total amount of issued green bonds.

This trend observed in the listed real estate industry in Europe is also part of a global megatrend. According to Reuters, the EU is expected to eventually become the biggest issuer of green bonds globally, and NN Investment Partners has ventured to say that it expects the green, social and sustainability bond market to reach a total of €EUR 1.1 trillion worth of issuances this year. We will continue monitoring very closely this market, following the European listed real estate companies and assessing how much our industry is adding to this goal. We’ll keep you posted! And in the meantime, you can consult the new “Green Bonds” section in our monthly LTV report for more information.