European IPO Outlook over the past decade

by Iskren Marinov, Index analyst and Membership manager

In this blog post, the EPRA Index and Research team takes a peak at the dynamics of the IPO activity in Europe during a 10 year period between 1 January 2013 and 31 August 2022.

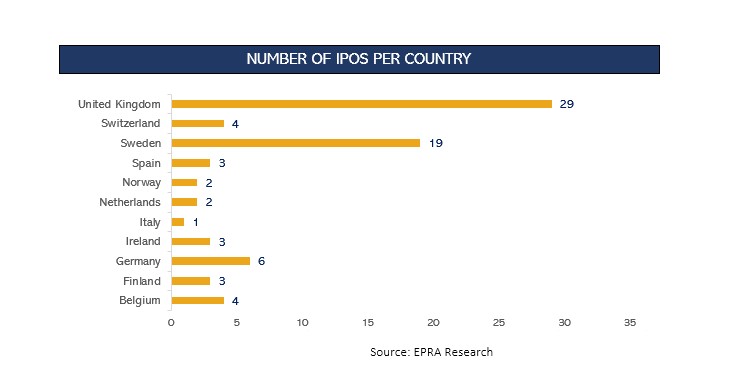

In terms of scope, this overview includes all listings of REITs and other real estate holding companies (excluding residential developers, construction and other real estate services companies) on European Developed markets stock exchanges - in total 76 flotations in 11 countries. In addition, the direct listings such as the Spanish Socimis on the alternative segment of the Madrid Stock exchange (BME Growth), are excluded since they have almost no free float.

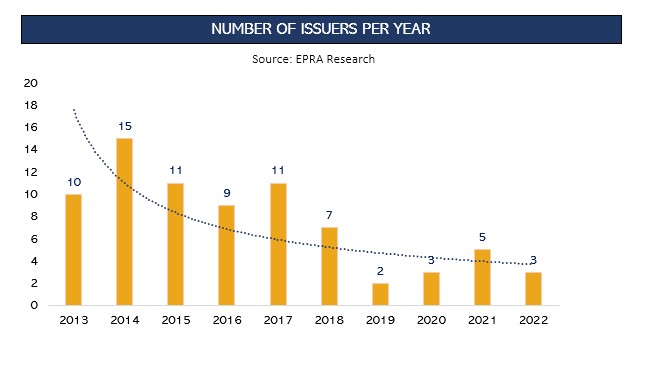

As per Graph 1, there is a clear downward trend in the number of companies going public in the period starting from 2013 until 2022. In the first five years, 58 listings took place, while there were only22 between 2018 and 2022. In total, the 76 companies raised EUR 6 Billion in their IPO’s over the 10 year period and represented a total market capitalisation of EUR 36.87 Billion.

Following the outbreak of Covid-19 in February 2020, 11 companies went public and only two listed after the outbreak of the war in Ukraine. Going public was most attractive in Sweden in the post-Covid environment with 6 listings, followed by the UK. In total, the London Stock exchange witnessed the largest number of IPOs during the last 10 years (29 in total). While the listings in the UK and Sweden have been surging during the period, no single IPO took place in France* and only one in Italy. (see graph2).

>*In 2017 Carmila technically merged with the listed Cardety, but in practice it allowed Carrefour to float its property unit (Carmila).

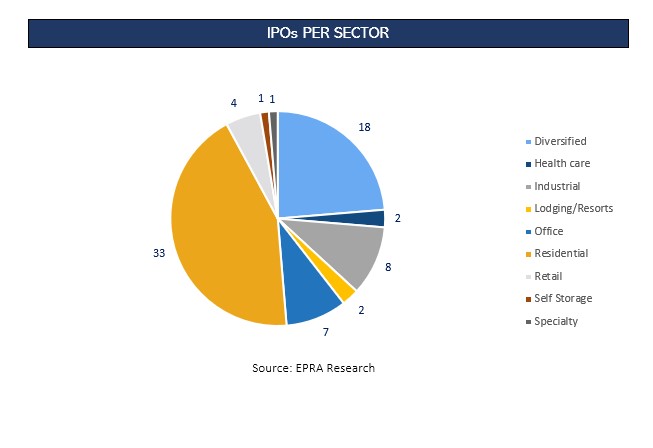

In terms of sector allocation, over 40% of the newly listed companies were in the residential sector, followed by 18 in the diversified and 7 of them focused on industrial assets (see Graph 3) While over the 2013-2018 period, the traditional sectors (office, retail) were equally represented, this hasn’t been the case during the past four years. Starting from 2019, out of the 13 companies that went public, 7 were in the residential sector, three in the industrials and diversified.

From a company perspective, the Spanish Merlin Properties, had the biggest capital raised with almost EUR 1.3 Billion , followed by the German residential LEG Immobilien at EUR 1.170 Billion. The Dutch/Czech warehouse focused company - CTP had the biggest total market capitalization of EUR 5.6 Billion in 2021.

Out of all 76 companies that were listed between 2013 and 2022, only 10 were fast tracked* to the FTSE EPRA Nareit Developed Europe index – 6 of them in the residential sector, five were listed in Germany and only one REIT managed to fulfil all fast track criteria.

The slowdown trend will probably continue in the short term given the challenging economic environment and our team will continue monitoring the market and perform a regular update.

*More information on the fast track rules can be found in the Index Ground rules here.