European Developers show first signals of recovery

European Developers show first signals of recovery

By David Moreno, CFA. Indexes Manager at EPRA

Homebuilders and developers traditionally have been seeing in continental Europe as a niche sector with some potential to grow, but also with significant challenges given its procyclical nature and substantial volatility. However, in the last decade the sector managed to expand its borders beyond the UK, where it was already a consolidated industry already several years ago, and finally started calling the attention of both analysts and investors.

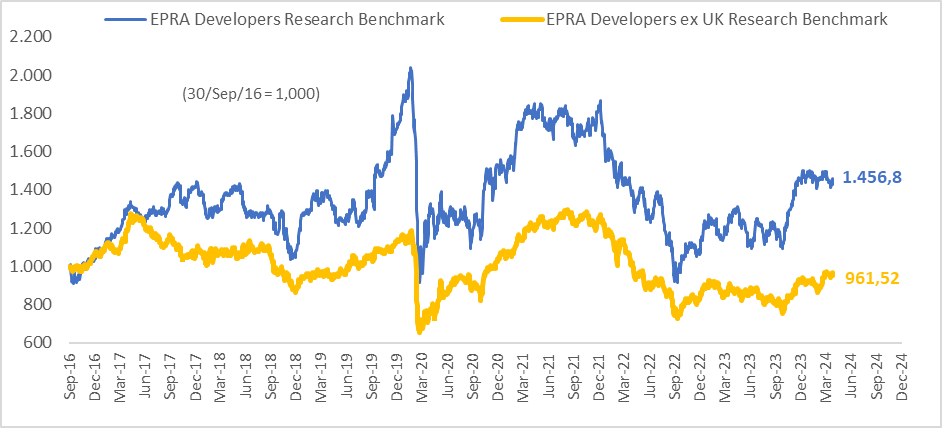

In 2021 EPRA launched its EPRA Developers Research Benchmark (EDRB) in the middle of a great enthusiasm, where many investors were optimistic thinking that the main difficulties were left behind after a global pandemic that affected many industries, including homebuilding. The 5-years history at that time provided an excellent perspective not only of several possible scenarios that every investor should have in mind, but also the potential growth that this sector has. Then, the Ukrainian conflict detonated in Feb/22, pushing the European inflation to levels not seen in almost 30 years and forcing central banks to increase interest rates in one of the fastest hiking cycles ever. The impact was strong on the homebuilding industry, pushing the EDRB to lose almost 50% of its value in 9 months, followed by a moderated recovery in 2023 once the expectations for additional rate hikes began to shift.

EPRA Developers Research Benchmark: 26/Apr/24

Source: EPRA & Bloomberg.

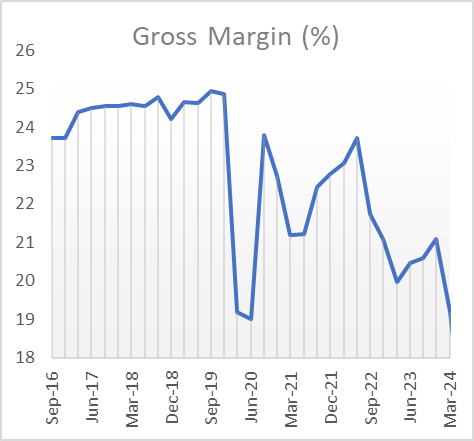

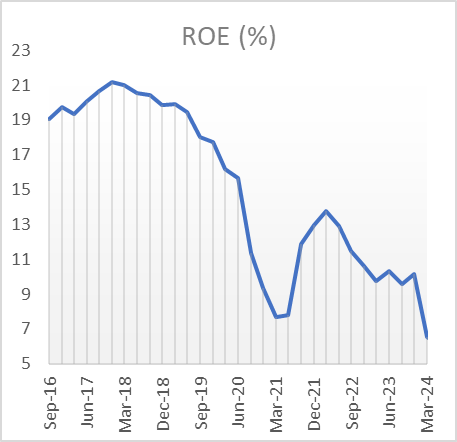

A combination of expensive materials, high financing costs, scarcity of land and limited households’ demand affected many European homebuilders, who were used to get gross margins close to 25% and generate returns on equity of almost 20, just in a few quarters many companies were seeing their operational metrics deteriorating. Even one of the constituents with exposure to other activities like construction and infrastructure (YIT OYJ, Finland) saw the contribution of homebuilding to its total EBITDA dropping below 50%, then triggering its deletion from the EPRA Developers Research Benchmark in its semi-annual review this month.

Profitability of European Developers and Homebuilders

Source: EPRA & Bloomberg.

In 2024 the picture seems to have started changing. Inflation is now getting closer to the central banks’ targets and economic growth is likely to have bottomed-up. The conditions are set for a more flexible monetary policy, with many economists and investors expecting first rate cuts in summer this year. 10y Government bonds already show yields almost 30 bps lower than 6 months ago and equity markets gained almost 25% in the same period.

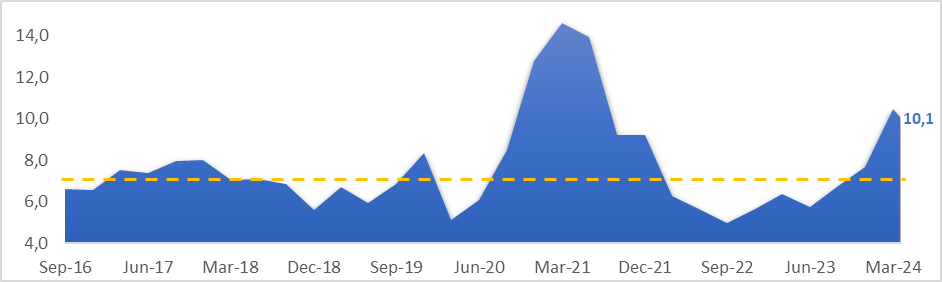

European developers had a positive end of 2023, with a total return of +20.3% in Q4 and remains stable YTD in 2024 (-0.2%). The results season in April came with some positive upgrades in the guidance of many developers that started observing some recovery in their activity this year, although not materialized in their income statement yet. For the first time in almost two years, the developers’ enterprise value to EBITDA ratio is slightly higher than its long term average, reflecting some positivity from the main shareholders that should be reflected in stronger operational metrics by the end of the year. Again, difficult times seem to be left behind.

European Developers and Homebuilders: EV/EBITDA

|

Long term average: 7.7 |

Source: EPRA & Bloomberg.

|

Check EPRA’s website for more details on the EPRA Developers Research Benchmark: |