European Debt markets reveal renewed trust on listed property companies

By David Moreno, CFA. Indexes Manager at EPRA

Heading towards the end of September, at the door of the last quarter of the year, the debt markets seem to have renovated their trust in many listed landlords, showing interesting signals of how investors, rating agencies and some other market players are re-assessing the debt profile and credit risk of several REITs and property companies across the continent.

After a rapidly increasing trend on yields in Q4/22 – Q2/23 across the debt markets, mainly induced by the interest rate hikes by many central banks in a direct fight against inflation, in Q3/23 several debt and credit instruments issued by real estate companies showed some corrections, reflecting a more optimistic view on the future solvency and financial health of the sector. The Unibail-Rodamco-Westield’s yield curve is a clear example of such a signal, where the YTM of the short and medium-term bonds decreased an average of 31 bps and 19 bps respectively during the last 3 months and the long-term references had a slight increase. Similar movement was observed in the Vonovia’s 10y bonds that have decreased 34 bps compared to its peak in Mar/23 while Castellum’s longest bond (2029) also showed a correction of 35 bps from its high in Aug/23.

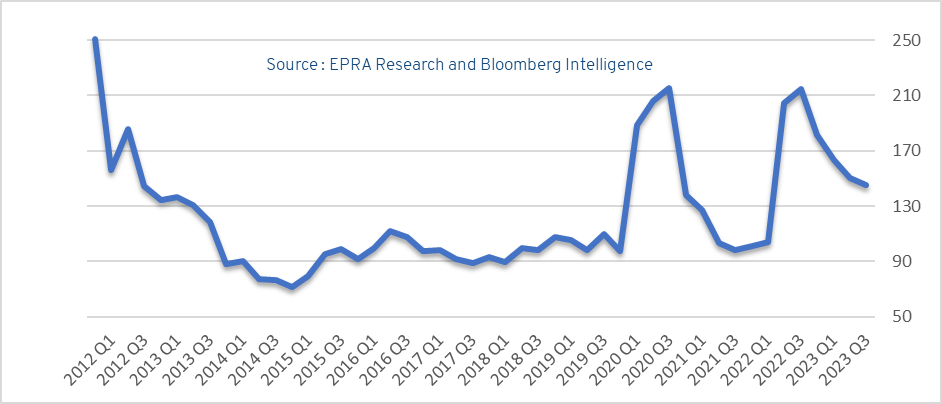

During the last 18 months, many property companies have made large efforts to control their leverage either by disposing of properties, refinancing debt, improving their operational figures, or adjusting their corporate structure. This has helped keep the aggregated LTV for the sector below 40% (August: 38.5%) in spite of some corrections in property values and higher financial costs. In addition, many companies have reinforced their relationship with banks and opened new credit lines. As a result, in Q3/23 the main rating agencies stopped downgrading the outlook or the credit rating of some real estate companies and even released some upgrades, recognizing the industry’s effort to reinforce its debt profile. In a similar way, the CDS market is also pricing lower credit risk for the largest property companies in Europe, where the average cost for the 5y CDS decreased by 75 bps compared to its peak in Q2/22.

5y CDS - Average for Top European Listed Property Companies *

* Gecina, British Land, Landsec, Klepierre, URW, Hammerson, Segro.

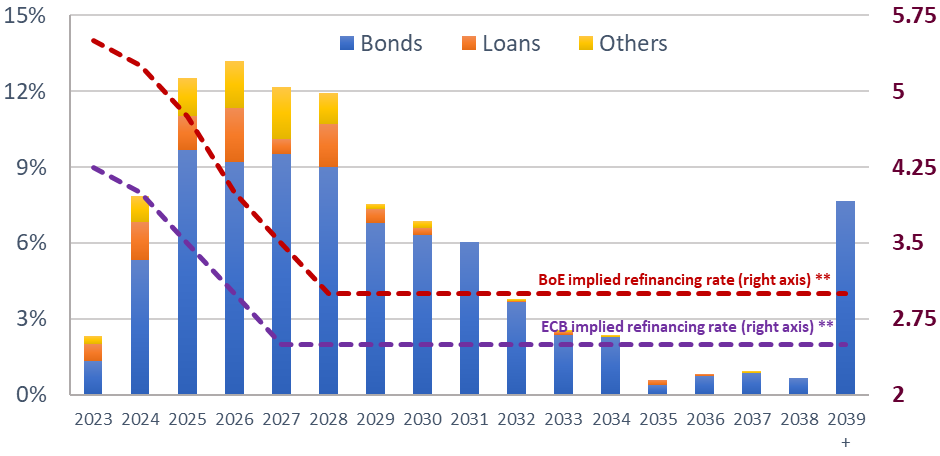

On the other hand, after several consecutive interest rate hikes, most of the central banks started adjusting their guidance, making clear that either they are very close or already reached their target. Simultaneously, many economists, analysts and investors started adjusting their expectations around the future monetary policy in Europe, discounting some interest rate cuts by late 2024 and 2025. Therefore, looking at the debt maturity schedule for listed real estate in Europe, where the largest concentration is in the period 2025-2028, it is important to highlight that most of the property companies will have enough time (around 18 to 36 months) to adjust their cashflows for attending the debt maturing in the medium term, which is also going to coincide with the period of normalization in the monetary policy where the interest rates are expected to be significantly lower than the current levels.

Debt Maturity: Top 50 European property companies*

* Top 50 constituents of the FTSE EPRA Nareit Developed Europe index. ** Implied rate derived from the derivatives market

In conclusion, the debt and credit markets seem to start pricing lower levels of risk in the listed real estate industry, in a moment where many property companies are strengthening their debt profile and the direct property markets are still showing corrections. Then, it is a matter of time for the equity markets to start pricing a more positive outlook for the sector in the coming years as well.

|

Check EPRA’s research reports here: |