Listed Real Estate in context: A sector comparison

By David Moreno, CFA. Indexes Manager at EPRA

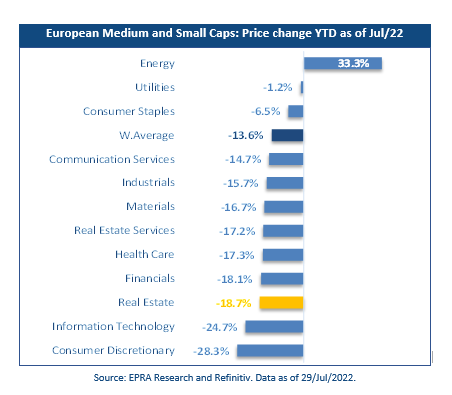

Global financial markets have faced a very challenging environment this year. High inflation, raising interest rates, slow economic growth and political uncertainty erased the post-pandemic recovery and turned negative most of the asset classes. Looking at Medium and Small caps in the European equity universe, almost all the sectors showed year-to-date negative returns in July. Real Estate pointing a surprising -18.7% (FTSE EPRA Index Dev. Europe was -18.45%) despite all evidence that property companies were well prepared for such context as well as showing positive impact that inflation can have on their corporate profits . The graph below was even more worrying back in Jun/22 where the YTD return for the EPRA index was -27.5%.

However, corporate results released in July brought back some optimism into the markets as many investors realized that property companies are navigating this challenging context quite well. Therefore, the positive returns observed in July (EPRA index +12.49%) contributed to restore confidence in the sector. However, there are still some signals of overreaction, where listed property companies show positive fundamentals but low valuations compared to other sectors.

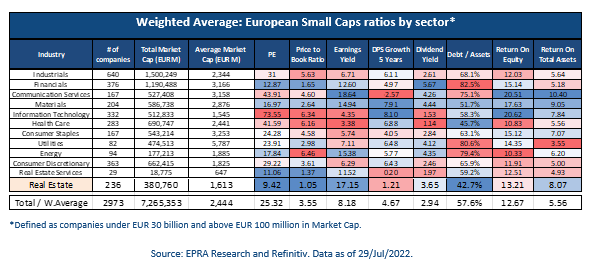

- Defined as companies under EUR 30 billion and above EUR 100 million in Market Cap.

- See EPRA report Interest rates and Inflation: What are the challenges for listed real estate?https://prodapp.epra.com/media/EPRA-Interest_rate_and_inflation-June_2022_1654762729912.pdf

- See EPRA report Inflation and short-term impact on listed property companies. https://prodapp.epra.com/media/Inflation_Analysis_-_February_2022_1644232083444.pdf

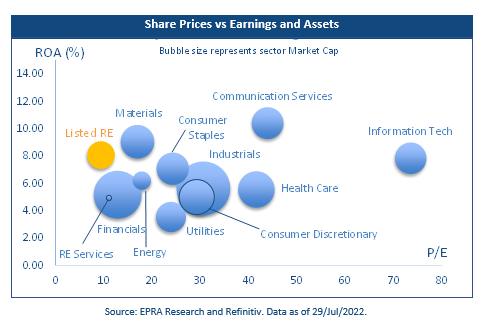

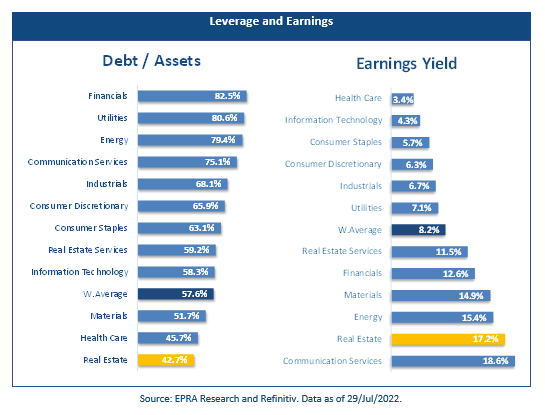

In terms of corporate profits, listed real estate shows a ROA of 8.07% compared to 5.56% for all the sectors, being communication services the highest (10.40%) and utilities the lowest (3.55%). Similar story for ROE with listed real estate showing 13.21% and the average for all the sectors 12.67%. Simultaneously, property companies show the lowest Debt/Assets ratio (42.7%) and the second highest earnings yield (17.2%) across all the comparable sectors. However, all these positive figures are not properly reflected in market valuations, where listed real estate shows a modest P/E ratio of 9.42x compared to 25.32x for all the sectors and even below industries like financials 12.87x, materials 16.97x and real estate services 11.06x.

The only ratios where listed real estate is not in a top position are those related to dividends. This is not a surprise given the nature of the companies in the sector. Most of the landlords aiming for a stable and resilient rental growth, with a long term horizon and many of them being obliged to distribute dividends under the REIT regulation. Therefore, it is just a matter of time for property companies to get their market valuations aligned with all the other sectors. This represents a significant opportunity for investors with a long term perspective aiming to get positive returns in a dynamic, resilient and stable industry.

Check EPRA's research reports here: