Estimating a green premium in listed real estate bonds

By David Moreno, CFA. Indexes Manager at EPRA

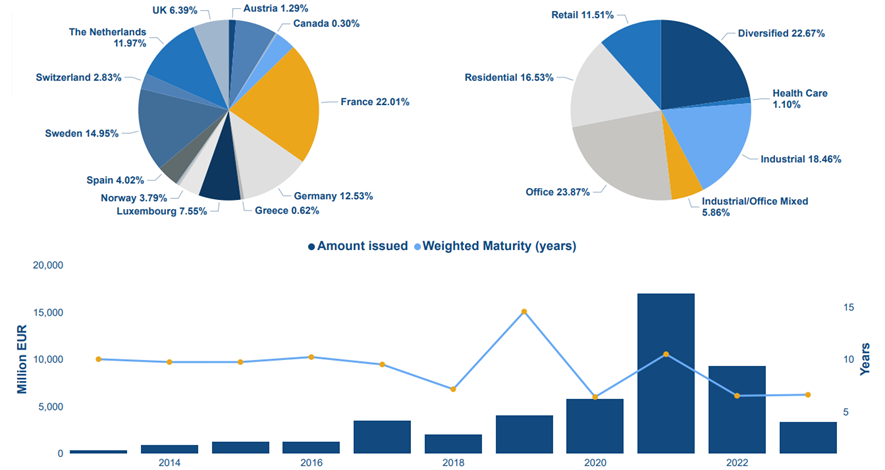

The importance of green bonds has risen in the last few years, supporting the expansion of sustainable investments and becoming an attractive vehicle for both issuers and investors, with the listed real estate industry having been a key player in the evolution. From December 2013 until November 2023, the constituents of the FTSE EPRA Nareit Developed Europe Index and the EPRA members issued a total amount of EUR 48,463 Million in Green Bonds, with 2021 being the year with the largest number of green bonds issued by listed property companies (see the Green Bonds section in our LTV Monthly Monitor, available here).

Exhibit 1: Evolution and current composition of real estate green bonds

Source : EPRA Research, Data as of Nov/23.

As an increasing number of corporate issuers prioritize the issuance of “green” instruments, the concept of green premium, has become central when talking about investment and financing decisions. Several studies have already studied the differential in yields for green bonds vs corporate bonds in different periods and industries, where some of them identified significant evidence of presence of a green premium in different geographies that in average represented a lower yield of around 1.8 bps to 5 bps (see EPRA’s report: Estimating a green premium in listed real estate bonds, available here). In 2023, the European Markets and Securities Authority (ESMA) presented a study covering more than 9,000 bonds issued between 1990 and 2023 and concluded that there was evidence of a green premium in the past, but such premium disappeared in 2022. Having these studies as a reference point, EPRA decided to analyse the green bonds issued by its members and determine the presence of a green premium.

The EPRA green bonds database includes 249 green bonds issued by current and former constituents of the FTSE EPRA Nareit Developed Europe Index as well as EPRA members over the past 10 years. With the purpose of comparing green bonds with corporate bonds issued by the same property company, where the only significant difference is the green label, a comprehensive screening was applied following a simple filtering criteria:

- Existence of a direct comparable no-green corporate bond: Only green bonds that have a comparable no-green bond issued by the same property company with similar characteristics (coupon, currency, duration, seniority) have been included in the study.

- Availability of data: bonds for which the historical figures since the issuance date were publicly available.

- Rating: Bonds with an investment-grade credit rating (AAA to BBB-).

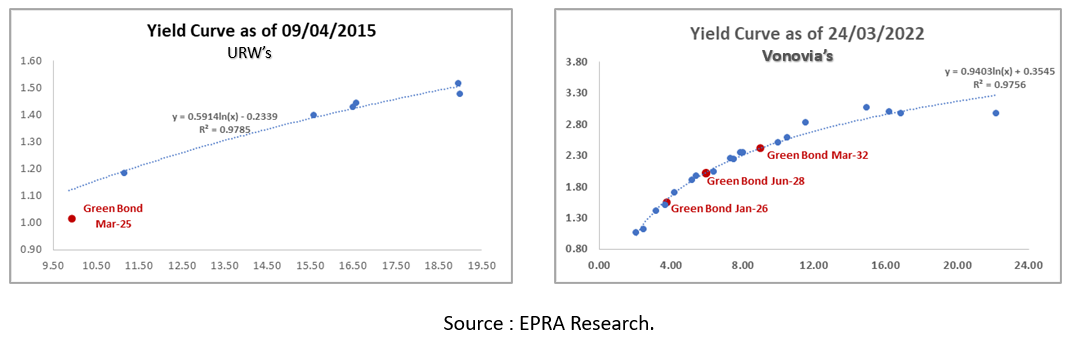

Those green bonds satisfying these criteria were matched with corporate bonds sharing similar characteristics (e.g. currency, rating, bond structure, seniority), and paired based on their duration. In addition, knowing that Vonovia and Unibail-Rodamco-Westfield have a significant amount of active bonds with enough liquidity to draw a yield curve, the green bonds issued by these two companies were incorporated as well, resulting in a total of 19 pairs of bonds issued between 2014 and 2022 by 11 companies who are constituents of the FEN Developed Europe Index or EPRA members.

Exhibit 2: Yield Curves at green bonds issue date

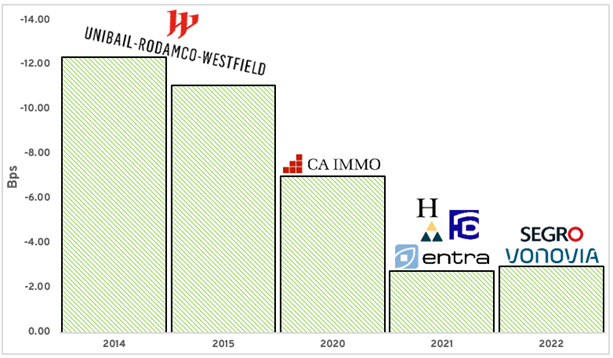

A regression analysis was conducted using the difference in Yield to Maturity as the dependant variable (Y) and the difference in duration as the independent one (X), founding evidence of an average green premium of 8.3 bps on the issue date for plain-vanilla bonds and 4.5 bps for callable bonds. However, the analysis also revealed a decreasing trend for such green premiums overtime, changing from 11 bps in 2014-2015 to around 2 bps in 2022. Furthermore, no statistically significant evidence of green premiums was found as of Sep/23, suggesting a similar conclusion to the above-mentioned report by the European Securities and Markets Authority.

Exhibit 3: Historical evolution of green premium in listed real estate bonds*

Source : EPRA Research, Data as of September, 2023.

* Considers only green bonds issued by property companies that have direct comparable standard corporate bonds

These results confirm that Issuing green bonds has been beneficial for listed property companies in Europe, where the changing macroeconomic conditions and regulatory uncertainty could have affected the evolution of the green premium. In particular, the upcoming regulatory changes (EUGBs) and the low liquidity observed in 2022-2023, mainly as a result of the increasing interest rates and a more restrictive monetary policy, played a key role in the dynamics of the green bonds market, reducing the number of property companies issuing new bonds and affecting the premium. However, such conditions are starting to change now, opening new opportunities for REITs and property companies to raise capital under reasonable cost and finance new sustainable projects, what eventually could create the conditions for green bonds to recover the premium observed in the past.

|

Check EPRA’s research reports here: https://www.epra.com/research/market-research

|