Is portfolio diversification different under US tariffs? The role of LRE in the age of uncertainty

by David Moreno CFA, Indexes Manager

How diversified is your portfolio — really?

It’s a question that generalist investors often answer confidently. A mix of stocks, bonds, perhaps some commodities or alternatives, and the belief that uncorrelated assets will carry them through the storm. But what if the rules are changing? Are the US Tariffs announcements modifying correlations across asset classes and so optimal allocations? What if traditional diversification is no longer enough?

Those questions were explored by Oxford Economics in two reports sponsored by EPRA — one from 2019 and the latest from 2024 — looking at optimal allocation across major asset classes in Europe. And the message is clear: listed real estate (LRE) deserves a bigger role in the portfolio conversation.

Why is listed real estate even on the table?

Real estate isn’t new. But listed real estate often gets lumped in with equities or overlooked entirely. That could be a mistake.

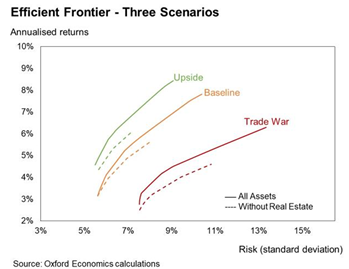

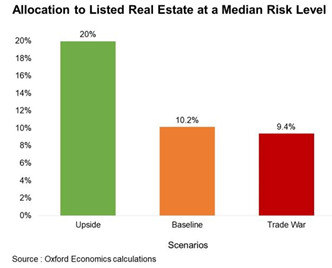

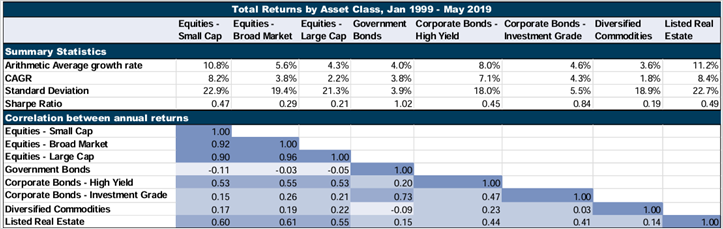

In their 2019 study, Oxford Economics analyzed the optimal allocation across six asset classes: equities, government bonds, investment grade corporate bonds, high-yield bonds, commodities, and listed real estate. They tested forward-looking portfolios under three scenarios for the coming decade, including a baseline and a pessimistic “Trade War” outcome.

Here’s the punchline: listed real estate earned its place. Even in the negative scenario, optimal allocations to LRE ranged from 9.4% to 10%, depending on investor risk profiles.

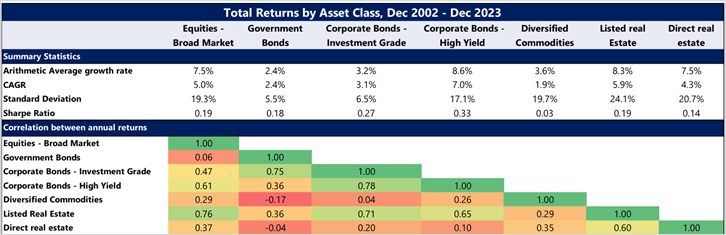

What’s changed since then?

Plenty. By 2024, the analysis was updated to include direct real estate as a seventh asset class. Despite the expanded universe, listed real estate still secured its place — albeit with slightly lower optimal allocations of 6% to 10% under the baseline scenario.

That’s not a downgrade. It’s a recalibration. In fact, the updated report shows that listed and direct real estate can play complementary roles. Listed real estate tends to appeal more to medium and high-risk investors seeking liquidity and exposure to niche sectors like data centers or self-storage, while direct real estate fits well in the core portfolio for income stability and lower volatility.

Source: Oxford Economics calculations

But isn’t listed real estate just more equity?

Here’s where it gets interesting.

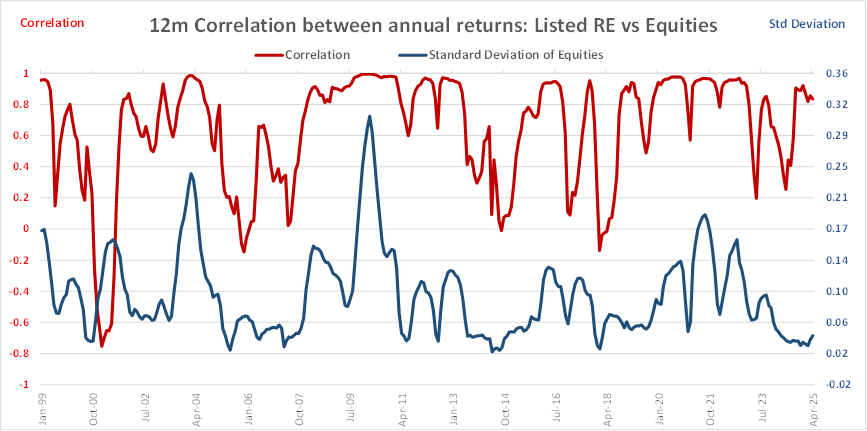

In recent months, especially after the U.S. tariff announcements in April and May 2025 — correlations across the board have spiked. The 12-month rolling correlation between listed real estate and equities sits at 0.83, raising eyebrows among diversification seekers.

Source: EPRA Research

So yes, in the short term, LRE can behave like equity — particularly during market stress. But this doesn’t make it redundant. What it does, instead, is highlight the importance of time horizon and macro regime awareness.

As Oxford Economics’ 2024 report explains, while LRE exhibits equity-like volatility, its medium- to long-term return patterns align more with direct real estate, particularly when lagged over multiple quarters, where correlations fluctuate between 0.6 and 0.8.

In other words: LRE zigs like equity today but could zag like property tomorrow.

Aren’t traditional diversifiers broken too?

Sadly, yes.

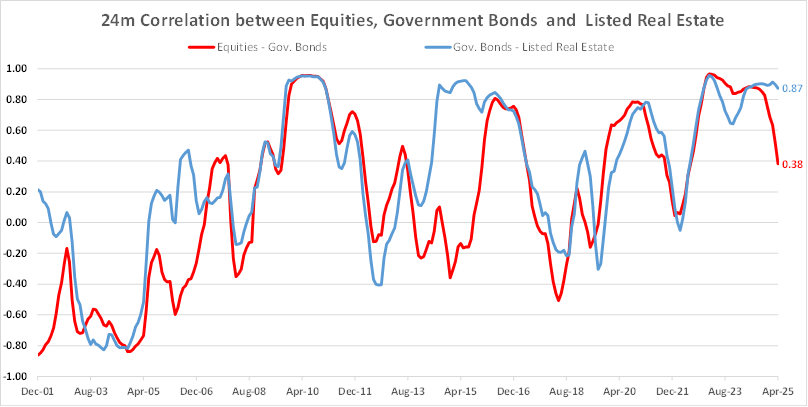

The 2y correlation between equities and government bonds has climbed to levels above 0.5 (currently at 0.38), a structural shift post the GFC in 2008-2009. That once-reliable hedge now moves — at least sometimes — in the same direction. Simultaneously, the 2y correlation between LRE and government bonds has followed a similar path, currently at 0.87.

Source: EPRA Research

Volatility across asset classes also converged during recent stress, making true diversification harder. It’s not enough to diversify by asset label anymore; you have to diversify by behavior — and listed real estate brings that nuance across all its property sectors, both traditional and alternative.

So, how should generalist investors think about LRE?

A good option is to think of listed real estate as your "satellite" strategy in a core-satellite portfolio:

- Your core: Bonds, blue-chip equities, and possibly direct real estate — stable, lower volatility.

- Your satellites: Listed real estate (with sectoral and geographic variety), infrastructure, and other alternatives — higher return potential, more responsive to market conditions.

In fact, Oxford’s 2024 report demonstrates that combining listed and direct real estate consistently yields higher Sharpe ratios than holding either in isolation. For example, portfolios combining both produced a Sharpe ratio of 0.77, compared to 0.69 for direct real estate alone.

But what about in bad times like... NOW?

Even under their downside 2025 scenario, allocations to LRE still showed up — 3% for medium- and high-risk investors. The fact that listed real estate isn’t dropped altogether speaks volumes.

Plus, the stable dividend profile of REITs provides income ballast, even during tough economic periods.

The final word: rebalance with intention

Markets evolve. So should your diversification strategy.

Oxford Economics’ work over two major reports — and a period of significant economic shifts — shows that listed real estate is no longer an “alternative.” It’s also a strategic tool. Therefore, LRE should not only be seen as a good diversifier for tactical asset allocation in extreme times like the current ones, but also as a valuable long-term investment that can be part of any strategic asset allocation.

So next time you are rebalancing your portfolio, ask not “What’s missing from my asset list?”, instead you can ask “What’s missing from my risk regime map?”

Chances are, listed real estate might be the answer.