H1-2025 Results in European Listed RE: Building on Strength and Stability

As we move through 2025, the European listed real estate sector continues to demonstrate remarkable resilience and adaptability. Despite the significant uncertainty observed this year in terms of macroeconomics and geopolitics, the latest results season revealed a sector that is not only navigating the changing market conditions but also capitalizing on new opportunities.

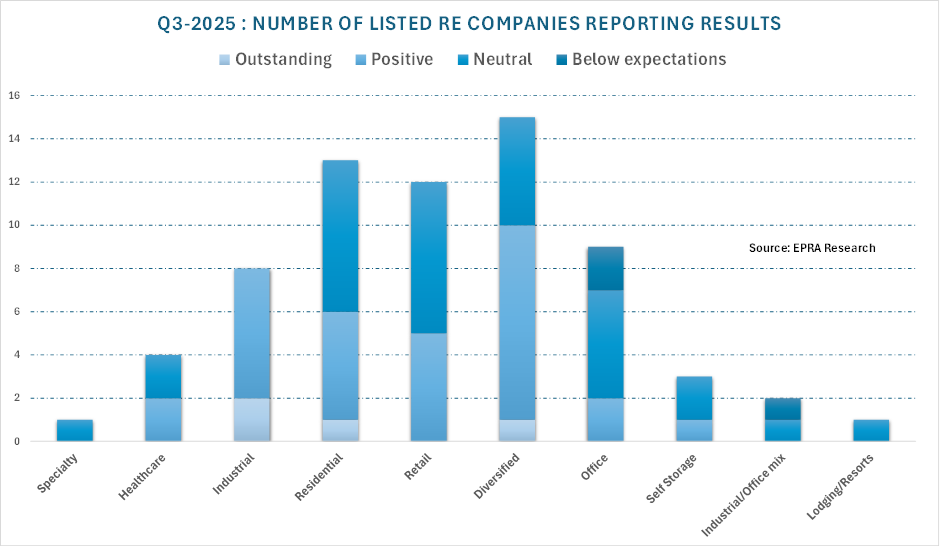

Between July and September, EPRA tracked a total of 68 companies across the continent reporting quarterly or semi-annual figures, where 61 of them showed positive or neutral results (aligned with market expectations), 4 of them reported outstanding figures (even increasing their own annual guidance) and only 3 of them did not reach market expectations. Here, we summarize some of the key trends in terms of operations, property valuations, financing conditions and earnings momentum that are shaping the industry’s positive outlook.

Operational Trends: Resilience and Steady Growth

Across the sector, operational performance remains robust. Rental income growth is a healthy, with most companies reporting positive changes both on a total basis and and like-for-like basis. In the latest results, the l-f-l rental growth typically ranged from 1% to 6%, often supported by indexation mechanisms and strong leasing activity, while some companies reported double digit total growth thanks to recent property portfolio expansion.

Occupancy rates remain high in most segments, particularly in residential, healthcare, and logistics properties, with typical occupancy rates ranging from 94% to 98% and a sector. Retail and office segments show more mixed results, with prime assets and well-located properties maintaining strong occupancy, while secondary locations may experience higher vacancy or slower leasing activity.

Cost control and operational efficiency are also prominent, as companies focus on maintaining margins in an environment of rising expenses, although the general cost of debt seems to be stabilizing. Many property companies and REITs are increasing their CAPEX and investing in portfolio expansion and asset upgrades, sustainability initiatives, and digitalization to enhance tenant experience and operational resilience.

Property Valuations: Stabilization and Signs of Recovery

After a period of downward pressure mostly derived from higher interest rates, property valuations are showing signs of stabilization. In several segments, especially industrial, retail, and residential, valuations are showing moderate uplifts. Except for one single office specialist, the range of property portfolio valuation changes in H1-2025 was 0% to 5%. Capital recycling is still a common strategy, with companies disposing of non-core assets and reinvesting in higher-performing properties or development projects.

Earnings and Financing: Positive Trajectory and Guidance

Earnings momentum across the sector is generally positive. Most companies reported earnings changes with a median of +3% to +7% and most results were in line with or ahead of expectations, with several raising their full-year guidance. The industrial and residential sectors in continental Europe showed strong results, mostly thanks to positive developments profits and strong demand for rental space boosted by the recent fiscal expansion in Germany. Dividend policies remain stable, with most companies maintaining or modestly increasing payouts.

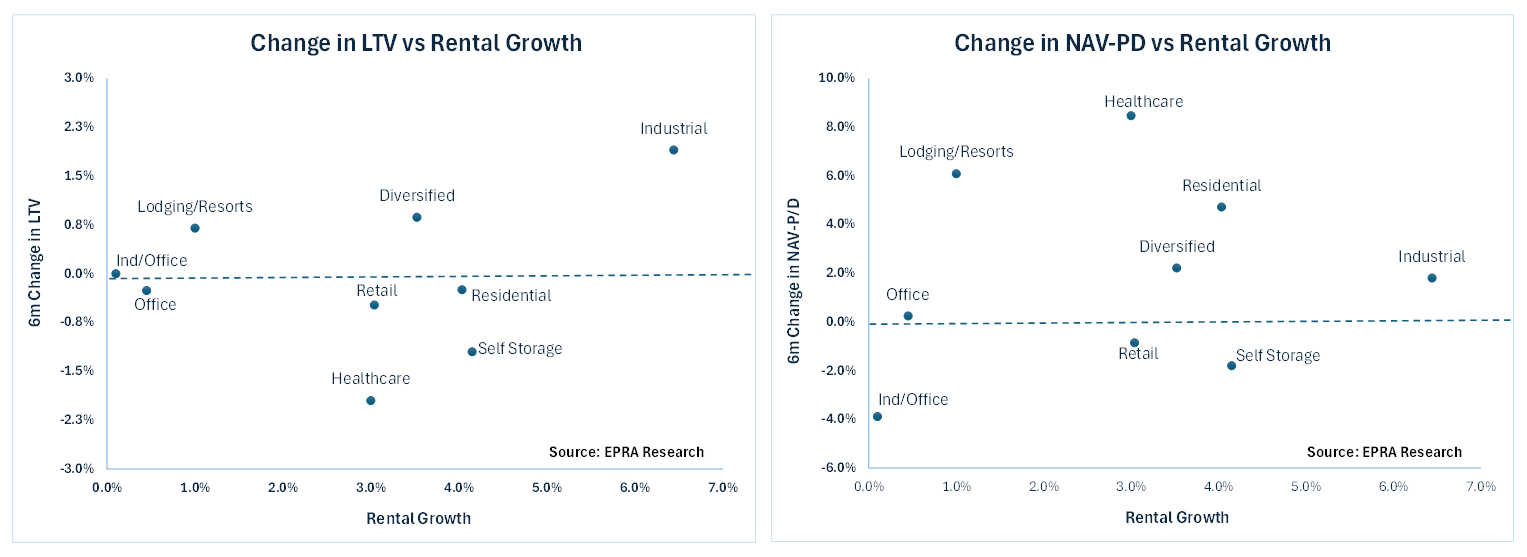

From the 68 companies initially covered, EPRA analysed 49 that reported metrics comparable with their peers in terms of rental growth, LTV and NAV.

The LTV ratios are generally stable or improving, with most companies reporting LTVs in the range 18% to 50%, with no significant change on an aggregated level compared to Dec/2024. However, companies with stronger rental growth are also showing a slight increase in LTV that seems to be perceived positively by investors, pushing for lower discounts to NAV and even turning to slides premium in some cases.

Sector Sentiment and Conclusions

Sentiment across the sector remains optimistic but cautious, while the overall tone was positive for most of the companies reporting. Several companies are expanding their property portfolios, and many others are focused on operational excellence, portfolio quality, and financial resilience.

Sector optimism is increasing after an extremely cautious results season in Q2-2025, where the tariffs announcements by the US government brought lots of uncertainty. During the 3rd quarter of the year, 44% of the companies reported positive results and guidance improvements and 6% outstanding results, which represents a significant improvement compared to just 0% outstanding and 41% positive results in the previous quarter. The percentage of neutral announcements also decreased from 53% in Q2 to 46% in Q3.

As the sector moves into the last quarter of 2025, the focus remains on operational and financial efficiency, capitalizing on rental growth opportunities, and managing costs. The stabilization of property values, combined with strong operational fundamentals and prudent financial management, provides a solid foundation for continued success. While macroeconomic uncertainty and sector-specific challenges persist, the European listed real estate sector is well-positioned to deliver resilient income and sustainable growth.