2026 - A year of normalisation for European listed real estate

By David Moreno, CFA, CAIA, EPRA Indexes Manager

After several years defined by unusual economic conditions, shifting monetary policy, and heightened geopolitical uncertainty, 2026 is shaping up to be the long‑awaited year of normalisation for European listed real estate. The sector enters the new year with improved fundamentals, stronger investor sentiment, and clearer macroeconomic visibility, setting the stage for a more balanced and sustainable growth cycle. In this article we present a short summary of the main trends expected for 2026 and EPRA’s outlook for the year. The full report is available here.

A more stable macroeconomic backdrop

One of the strongest tailwinds for listed real estate in 2026 is the stabilisation of the macroeconomic environment across Europe. Inflation is now gradually aligning with the central banks' targets. The euro area is expected to see headline inflation average 1.7%, slightly below the ECB’s 2% objective. This return to a “normal” inflation cycle has profound implications: it reduces uncertainty, supports consumer confidence, and provides a healthier foundation for corporate planning.

Growth prospects, while moderate, also look constructive. The ECB projects GDP growth in the range of 1.0–1.2%, supported by resilient labour markets, rising real wages and fiscal stimulus in for of the largest economies in the continent. Meanwhile, several non‑eurozone markets show even stronger momentum. Sweden is forecast to expand 2.6–3.1%. Switzerland is set to deliver 1.5–1.7% GDP growth with ultra‑low inflation. In terms of interest rates, the easing cycle appears to be nearing its end, with major central banks expected to halt rate cuts at least until mid-2026. Together, these trends point to a Europe that is not booming but stabilising. And for real estate, stability is very good news.

A sector poised for mean reversion

Listed real estate’s performance in 2025 offered hints of the positive shift underway. The FTSE EPRA Nareit Developed Europe Index delivered a 6.8% total return in euros in 2025, marking a solid rebound from the slight decline in 2024. Importantly, the sector outperformed the broader Developed Index, signalling renewed investor confidence.

Yet despite this progress, real estate still lagged general equities, which can be mostly associated with ongoing uncertainty in some of the most important real estate fundamentals following nearly five years of abnormal market conditions. This gap between sentiment and intrinsic performance creates fertile ground for mean reversion in 2026.

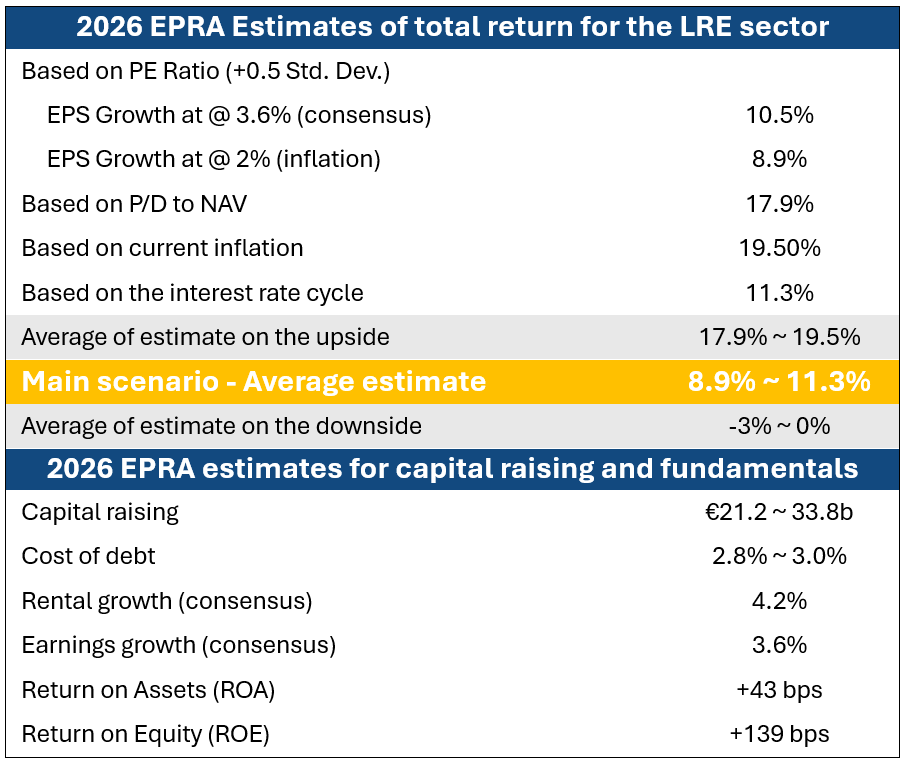

EPRA’s historical analysis suggests that under a “normal” inflation cycle, the sector has historically delivered 6.4–19.5% total returns, implying a wide but favourable potential range for the year ahead.

Historical Total Return of Listed RE under different inflation cycles

Normalising property markets and structural tailwinds

Property market consensus points toward a steady, income‑driven recovery. According to the ULI & PwC Emerging Trends in Real Estate Europe 2026 report, total returns for European commercial real estate are projected to average around 6.4%, supported mainly by rental growth, rather than capital appreciation. Demand continues to shift toward structurally supported sectors such as:

- Data centres, driven by AI and cloud expansion

- Student housing, supported by demographic and mobility trends

- Healthcare, benefiting from ageing populations

The key catalyst for commercial real estate’s improving outlook is the normalisation of the macroeconomic environment, characterised by lower inflation and more stable interest rates. These dynamics have eased borrowing costs and narrowed the debt funding gap, fostering renewed confidence across capital markets. investors.

Capital markets regain confidence

Another encouraging sign: capital raising activity surged in 2025, reaching EUR 29.7 billion, the highest level in four years and the third‑highest over the past decade. This rebound reflects both improved investor appetite and greater stability in financing conditions.

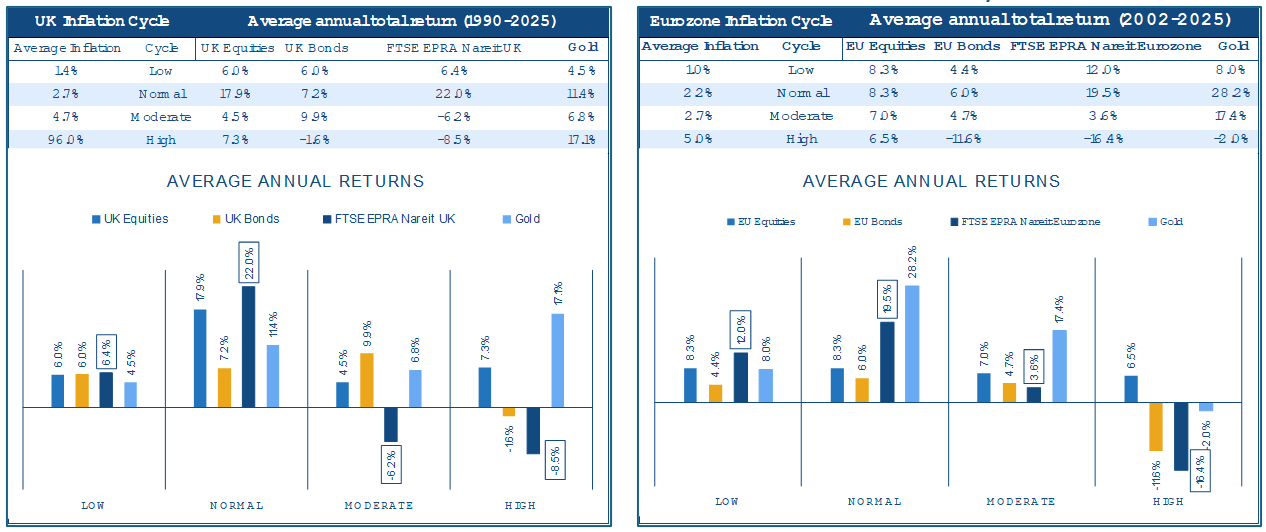

The average cost of debt across the FTSE EPRA Nareit Developed Europe Index stands at 2.85%, and refinancing risks appear manageable. With EUR 33.9 billion of bonds maturing over the next 18 months, at coupons broadly aligned with current rates, most companies should be able to refinance without meaningful pressure.

Bonds maturing in the next 5 years in EUR billion

This is a key break from the tightening cycle of 2022–2023, during which higher yields strained balance sheets and valuation models. In 2026, financing is no longer a headwind.

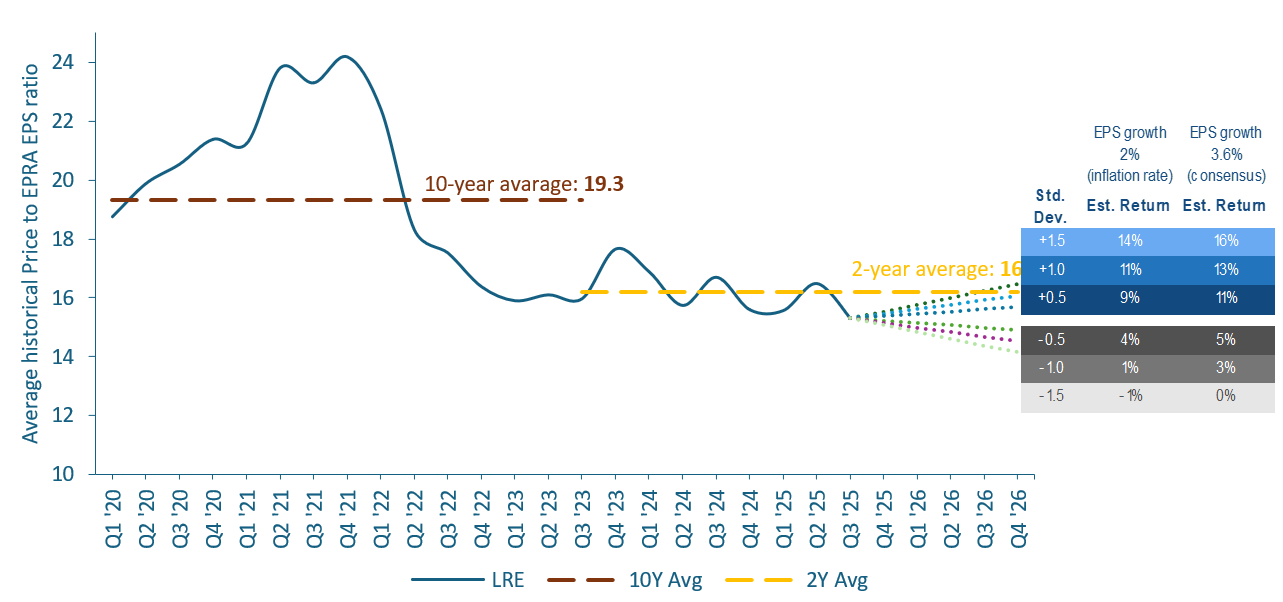

Valuations and profitability look strikingly attractive

Perhaps the strongest argument for optimism lies in valuation. As of late 2025, the European listed real estate sector trades at an average 26.8% discount to NAV, a level observed in only 12% of monthly observations since 1989. Historically, such wide discounts have been followed by strong future returns:

- 17.9% average annualised return over 1 year

- 12.1% over 3 years

- 11.9% over 5 years

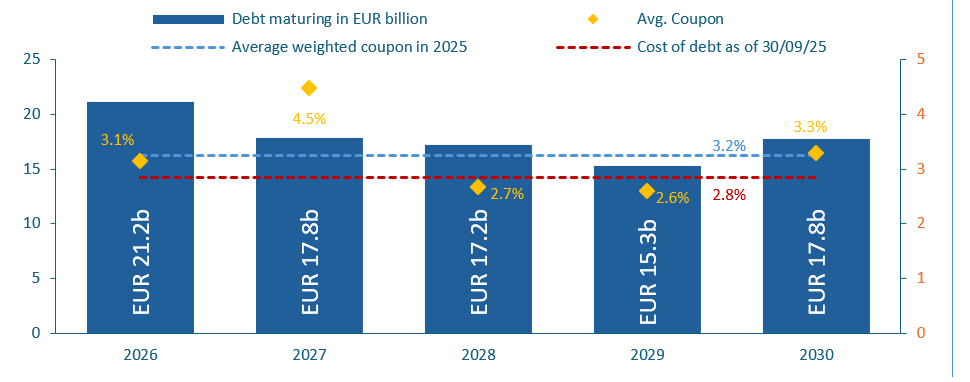

Similarly, the sector’s trailing price‑to‑EPRA earnings ratio stands at 15.3, well below the 10‑year average of 19.3. Assuming an EPS growth rate aligned with consensus (3.6%), a return to typical valuation multiples would imply approximately 11% total returns for 2026.

In terms of profitability, EPRA expects ROA to increase by 43 bps and ROE by 139 bps in 2026. Combined with rising rental income, projected at 4.2% growth well above inflation, earnings power should strengthen across the sector.

Together, these metrics suggest a market that is not only stable but meaningfully undervalued.

Forward‑looking outlook: A positive year with manageable risks

EPRA’s combined scenario analysis points to a base‑case return range of 8.9% to 11.3% for 2026, with upside scenarios reaching 17.9%–19.5% depending on valuation normalisation, inflation cycles, and earnings trajectories.

Key risks remain real: monetary policy uncertainty, geopolitical tensions, and shifts in sentiment. But compared to the challenges of recent years, these risks feel more familiar, better understood, and easier to navigate.

Historical quarterly average price to EPRA earnings ratio and estimates

Conclusion: A strong foundation for the next real estate cycle

European listed real estate enters 2026 with clearer visibility, healthier balance sheets, stronger fundamentals, and compelling valuations. The sector is no longer recovering from shocks, it is re‑aligning with long‑term norms. For all market participants, 2026 offers something invaluable: a return to normality supported by stable cashflow generation, revenues and earnings growth and alignment with long-term megatrends.